Georgia Foreclosure Process

In the state of Georgia foreclosure can happen as quickly as 120 days but may extend to up to 180 days. For options on how to avoid foreclosure visit our owner options page.

Step 1: 30 Days Late on Mortgage Payment

What happens when I’m 30 Days Late on My Mortgage Payment?

Most mortgage lenders will give you a grace period of 15 days before sending you a document called a Notice of Default. (example: mortgage is due by the 15th of the month, lender may wait until the 30th to send notice). This is how the lender will formally begin the foreclosure process. You can expect your lender to start calling you to figure out your situation in order to get a better understanding of your ability to pay your mortgage. You can also expect late fees to be applied to your monthly mortgage payment. Lender will notify credit bureaus that you are 30 days delinquent on your mortgage. At this point you have between 90-150 days before your home goes to foreclosure auction.

To find out how to avoid foreclosure check out our Owner Options Page.

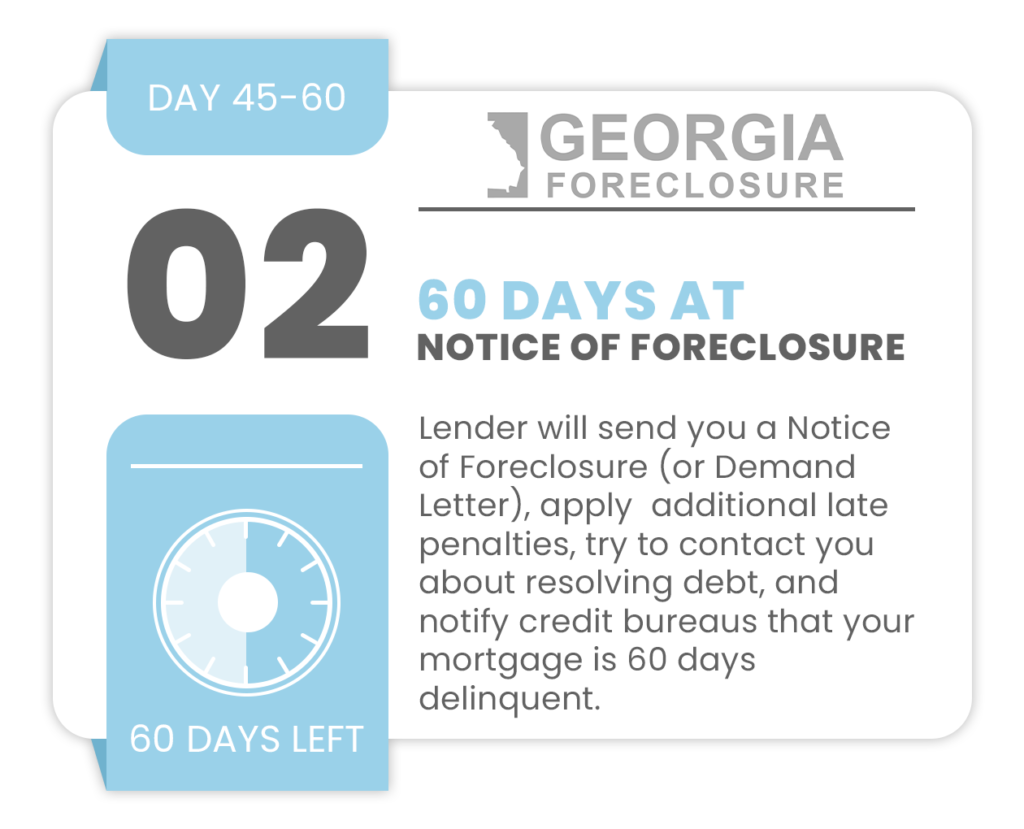

Step 2: 60 Days Late on Mortgage Payment

What happens when I’m 60 Days Late on My Mortgage Payment?

In addition to your mortgage lender sending you either a Notice of Foreclosure or Demand Letter expect increased efforts to get in contact with you in order to understand your current ability to repay your mortgage. Expect additional late penalties to be applied to your mortgage payment. Lender will notify credit bureaus that you are 60 days delinquent on your mortgage payment. At this point you have between 60-120 days before your home goes to foreclosure auction.

To find out how to avoid foreclosure check out our Owner Options Page.

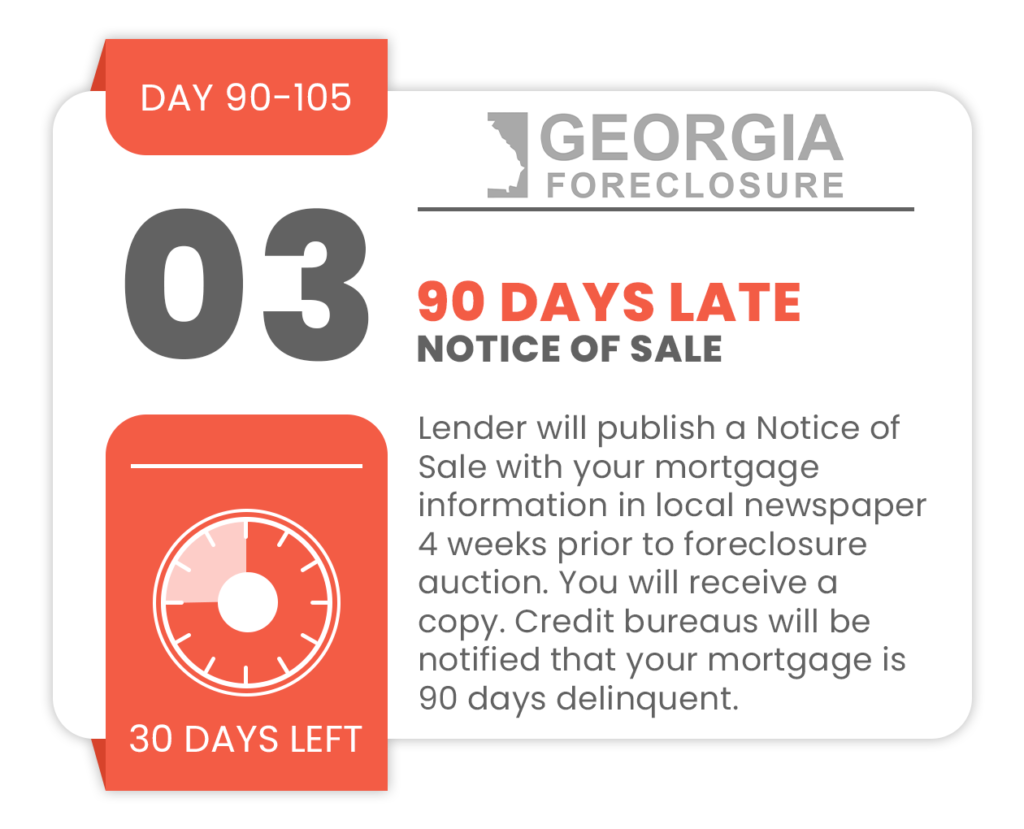

Step 3: 90 Days Late on Mortgage Payment

What happens when I’m 90 Days Late on My Mortgage Payment?

Once you are 90 days late on your mortgage payment your lender will move your mortgage from their collections department to their loss mitigation department. At this point they will retain an attorney to handle all foreclosure proceedings. You will be sent a document referred to as a Notice of Sale, Notice of Trustee Sale, or Notice of Sale Under Power. This notice will be published in your local county newspaper for at least 4 weeks prior to the scheduled foreclosure auction. This document includes mortgage information including the borrows name, property address, auction location and date, original mortgage amount, and mortgage lender information among other information. Additionally, credit bureaus will be notified that you are 90 days delinquent on your mortgage payment. At this point you have between 30-90 days before your home goes to foreclosure auction.

To find out how to avoid foreclosure check out our Owner Options Page.

Step 4: Your Home is Sold At Auction

What happens when my Home Goes to Foreclosure Auction?

Your property will be auctioned off to the highest bidder at your local county courthouse on the first Tuesday of the month between the hours of 10AM and 4PM. Lenders will notify the credit bureaus of your property foreclosure.

If your property has already been auctioned off, you may be entitled to some of the proceeds. To help collect these proceeds check out our Overage Collection Page.